Business

What one needs to tap into growing number of youth funds

With the problem of unemployment threatening to get out of control in Uganda, different players are responding by creating pools of funds into which the energetic group of people can tap into to create jobs that can sustain themselves while also enlarging the country’s tax base.

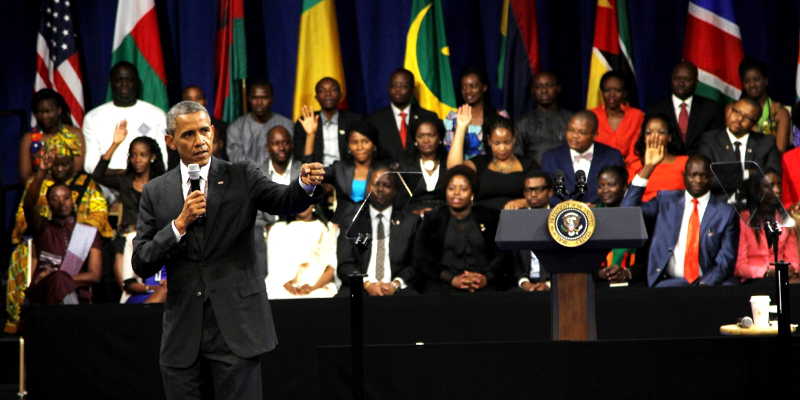

While attending the 28th Ordinary African Union (AU) Heads of State Summit in the Ethiopian capital Addis Ababa, President Yoweri Museveni met with the President of the Africa Development Akinwumi Adesina. And top on the agenda for the two dignitaries were the issue of energy and youth unemployment.

President Museveni pleaded with Adesina to work out ways of reducing the high cost of electricity in Uganda, arising partly from the fact the AfDB is one of the major creditors to the 250Megga Watt Bujagali Hydro Power Dam in Jinja which sells power to UETCL an an exorbitant cost of 11 cents per kilowatt hour, making it one of the most expensive in the world.

At the beginning of his current mandate, President Museveni asked the Energy Ministry to bring down the cost of power to 5 cents, in response to demands by Ugandan manufacturers.

Adesina revealed that the bank would float a 15year bond as a way of bringing down the cost of refinancing the loan.

Poor access to electricity is considered one of the major constraints to processing and manufacturing and hence to job creation especially for the youth.

But besides efforts in solving the energy jinx, the two leaders discussed efforts to finance youth projects.

Museveni pointed out that his government has put prioritised youth empowerment through a number of multi-billion shilling programmes such as the UGX. 265 Billion youth livelihood fund, the US$100million Uganda Women Entrepreneurship Programme (UWEP) as well as the US$100million a year Operation Wealth Creation (OWC) that seeks to transform the informal agriculture sector into a money economy.

Adesina also informed Museveni that AfDB is focusing on increasing access to credit for the youth including a US$8m.

But while there seems to be no scarcity of funds for the youth, constraints remain. One of the most critical is that most of the funding agencies require organised people.

According to a report by the Ministry of Gender Labour and Social Development, access to the youth livelihood fund requires thus;

A group of 10-15 youth aged between 18-30 years initiate proposals to the ministry for soft loans.

Indeed, although the youth livelihood programme does not requirement formal registration of the group, demonstrating evidence of organisation can be a decisive factor in determining who eventually wins.

Comments