Economy

Uganda Maintains Macroeconomic Stability as Finance Ministry Releases Q3 FY 2025/26 Expenditure Limits

The Ministry of Finance, Planning and Economic Development has released the Third Quarter (Q3) expenditure limits for the Financial Year 2025/26, citing sustained macroeconomic stability, a fast-growing economy, and strong fiscal discipline even as the country approaches a general election year.

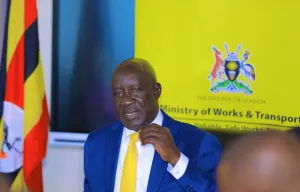

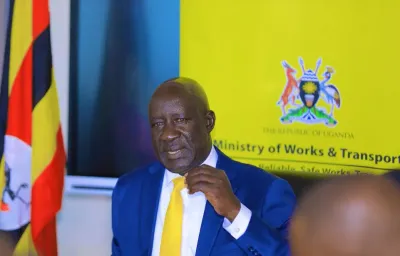

Speaking during a press briefing, the Permanent Secretary and Secretary to the Treasury (PSST), Dr. Ramadhan Ggoobi, said the expenditure limits were issued at a time when Uganda’s economy is performing strongly, unlike previous election cycles marked by inflationary pressures and exchange rate volatility. “The expenditure limits have been issued at a time when the country is experiencing extended periods of macroeconomic stability evidenced through a fast-growing economy, stable prices and the exchange rate,” Dr. Ggoobi said.

He added that the current economic environment is the result of deliberate and coordinated policy actions. “This achievement is not by chance but rather, on account of prudent economic management, attained through close coordination between monetary and fiscal policies.”

Fiscal Consolidation Guides Q3 Budget Releases

According to the Ministry, the FY 2025/26 Q3 expenditure limits have been shaped by the Government’s fiscal consolidation agenda, which prioritises macroeconomic stability and disciplined public spending.

Dr. Ggoobi noted that several guiding principles were considered in programming the third-quarter releases, including:

- Maintaining total expenditures within available resources to live within the country’s means

- Sustaining law, order, peace and security

- Providing fully for election-related expenditure to ensure peaceful and secure democratic processes

- Meeting minimum critical operational requirements for Ministries, Departments, Agencies and Local Governments

- Sustaining financing for wealth creation, key priority actions under the ATMS strategy, and their enablers in health, education and infrastructure development

“These Quarter Three expenditure limits have been informed by the fiscal consolidation agenda that prioritises implementation of Government’s objective of sustaining macroeconomic stability and maintaining fiscal discipline,” Dr. Ggoobi said.

Uganda’s Economy Shows Strong Growth and Resilience

Presenting the state of the economy, Dr. Ggoobi said Uganda continues to demonstrate impressive performance and resilience despite global economic uncertainties and election-year business cycles. “Uganda’s Economy continues to exhibit impressive performance and resilience amidst changes in the global environment and the election year business cycles.”

He revealed that GDP growth stood at 6.3 percent in FY 2024/25 and is projected to grow between 6.5 and 7 percent in the current financial year, with double-digit growth expected in the medium term.

As a result, the size of the economy is projected to reach USD 68.4 billion (Shs 249.4 trillion) in the current financial year.

Inflation, Exchange Rate Remain Stable Despite Election Year

Dr. Ggoobi said inflation remained stable at 3.1 percent in November and December 2025, describing this performance as rare during an election year. “Inflation remained stable for November and December 2025 at 3.1 percent. This is uncharacteristic of an election year. Indeed, Uganda registered Africa’s lowest Inflation rate in the past decade.”

He attributed the stability to increased food production, effective monetary policy, and the Government’s decision to directly import fuel through the Uganda National Oil Company (UNOC).

The Uganda Shilling has also remained strong, appreciating by 2.45 percent in the year ending December 2025. “Currently, the Uganda Shilling is the most stable currency in the World followed by the UK Pound Sterling and Hong Kong dollar,” Dr. Ggoobi said.

Exports, Investment and Tourism Record Strong Gains

The PSST revealed that exports of goods and services reached USD 13.4 billion in FY 2024/25, with USD 10.6 billion coming from merchandise exports alone.

For the year ending November 2025, exports of goods stood at USD 12.79 billion.

As a result, Uganda registered a Balance of Payments surplus of USD 2.37 billion for the year ending October 2025, compared to a deficit of USD 683 million a year earlier, the highest surplus in 15 years. The BOP surplus is also on account of an all-time high financial account surplus of USD 5.6 billion driven by good performance of FDI and portfolio inflows.

Foreign Direct Investment increased to USD 3.5 billion, while portfolio inflows reached USD 1.7 billion in the year ending October 2025.

Remittances from Ugandans abroad also rose to USD 1.6 billion (Shs 5.76 trillion) in FY 2024/25.

Tourism earnings reached USD 1.7 billion in FY 2024/25, driven by peace, improved competitiveness and government investment in tourism infrastructure.

Business Confidence Remains Strong

Despite the election year, business sentiment remains positive. As of November 2025:

- Business Tendency Index (BTI): 57.2

- Composite Indicator of Economic Activity (CIEA): 183.50

- Purchasing Managers’ Index (PMI): 53.8

All indicators remained above the 50-point expansion threshold.

Civil Society Commends Fiscal Discipline

The briefing was attended by partners under the Budget Transparency Initiative, including CSBAG Uganda, Uganda Debt Network and SEATINI Uganda.

Speaking on behalf of Civil Society Organisations, Pascal Muhangi, an economist at CSBAG Uganda, commended Government for maintaining macroeconomic stability and improving fiscal discipline, while calling for continued prudence in public financial management

Sunrise reporter

Leave a Comment

Your email address will not be published.