Uganda’s domestic revenue collections surged by nearly 40% in the 2024/25 financial year, according to the latest Auditor General’s Report. Total revenue grew from Shs 22.098 trillion to Shs 32.357 trillion, reflecting significant progress in tax compliance and enforcement.

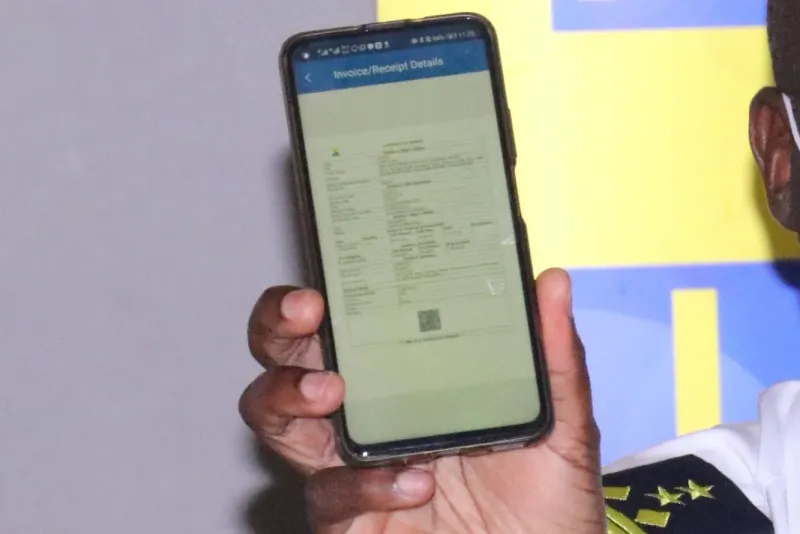

Government officials and tax experts attribute this improvement largely to strengthened digital tax administration systems introduced by the Uganda Revenue Authority (URA), notably the Electronic Fiscal Receipting and Invoicing Solution (EFRIS) and Digital Tax Stamps (DTS).

Digital Tax Tools Central to Compliance and Revenue Gains

Digital tax systems have become key elements in Uganda’s tax modernization strategy. EFRIS ensures that businesses issue fiscalised receipts and invoices electronically, making it harder to evade

Value Added Tax (VAT) and other duties. Meanwhile, Digital Tax Stamps help authorities track excisable products, including beverages, cement, and tobacco, from production or import through to the point of sale.

These systems are credited with improving compliance, reducing leakages, and broadening the tax base. URA’s ongoing digital transformation reflects a move away from traditional, paper‑based systems toward automated, data‑driven enforcement that is harder to evade.

Role of Digital Tax Stamps in Enhancing Accountability

Although wider digital reforms are recognised for driving compliance, Digital Tax Stamps have played a significant role in strengthening internal controls within excise‑based collections. With real‑time tracking of eligible goods, it is now more difficult for untaxed or illicit products to enter the market.

By ensuring that goods carry traceable, tamper‑resistant stamps, the system aims to reduce smuggling and under‑reporting, while increasing transparency across supply chains.

Growth Across Tax Categories

According to the Auditor General’s findings:

- Customs and excise revenue increased, reflecting stronger enforcement and compliance.

- VAT and other key taxes also showed robust improvements, indicating that broader digital tax administration reforms are yielding results.

While the exact contribution of each digital tax tool to specific revenue lines is still being assessed, the combination of DTS and EFRIS is repeatedly cited as a strong driver of improved performance.

Digital Tax Systems and Future Targets

Although the country’s tax‑to‑GDP ratio remains below recommended regional and global benchmarks, authorities are optimistic that continued digitalisation will help narrow this gap.

URA has also set ambitious revenue targets for upcoming financial years, with an aim to further leverage digital systems to deepen compliance and broaden the taxpayer base. Recent planning documents discussed using enhanced digital tools, including EFRIS enhancements and expanded DTS coverage, to meet these goals.

Modernising Tax Administration Beyond Revenue Growth

Beyond Direct revenue impact, adopting digital tools is seen as a long‑term modernization strategy for Uganda’s tax system. This includes:

- Improving data collection and analytics

- Streamlining compliance and reporting processes

- Reducing opportunities for human error or manipulation

- Enhancing transparency in tax administration

- Continued investment in digital systems such as EFRIS and DTS is expected to play a central role in enabling the country to meet future revenue objectives while improving service delivery and accountability.

Digital Systems Boost Revenue and Reform Tax Culture

Uganda’s recent surge in revenue collection demonstrates the positive impact of digital tax administration reforms. While challenges remain, including a still‑low tax‑to‑GDP ratio, the success of EFRIS and Digital Tax Stamps reflects a broader shift toward modern, technology‑driven tax systems that support compliance, fairness, and economic growth.

The Sunrise Editor

Leave a Comment

Your email address will not be published.